Seagull Option

外汇网2021-06-19 13:46:45

78

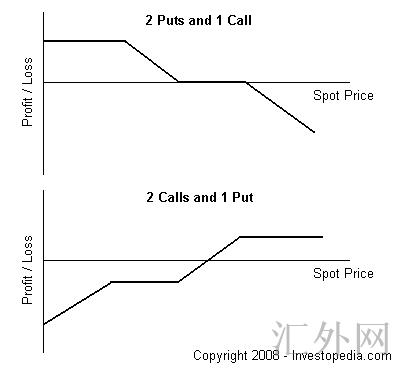

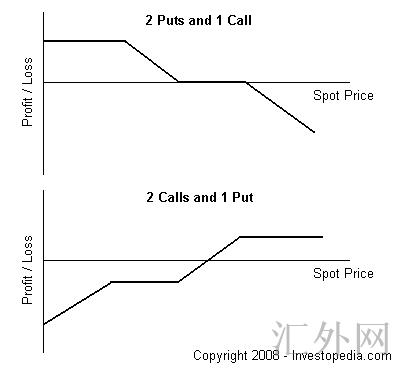

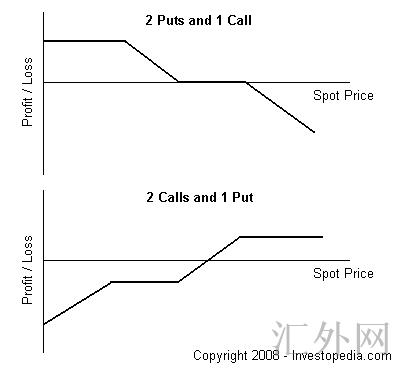

A three-legged option strategy, often used in forex trading, that can provide a hedge against the undesired movement of an underlying asset. A seagull option is structured through the purchase of a call spad and the sale of a put option (or vice versa).

标签:

- 上一篇: Volatility Skew

- 下一篇: Short Straddle

随机快审展示

推荐文章

- 黑马在线:均线实战利器 8724 阅读

- 短线交易技术:外汇短线博弈精讲 4059 阅读

- MACD震荡指标入门与技巧 4193 阅读

- 黄金操盘高手实战交易技巧 4539 阅读

- 做精一张图 3296 阅读

热门文章

- 港币符号与美元符号的区别是什么啊? 24995 阅读

- 我国各大银行汇率为什么不一样啊? 15119 阅读

- 越南盾对人民币怎么算的?越南盾对人民币汇率换算方法是什么 10277 阅读

- 百利好环球欺诈,不给出金,无法联系。 9795 阅读

- 黑马在线:均线实战利器 8724 阅读