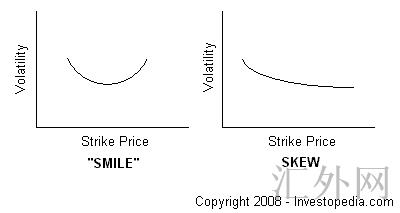

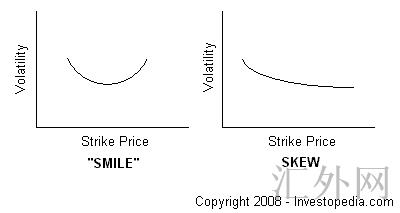

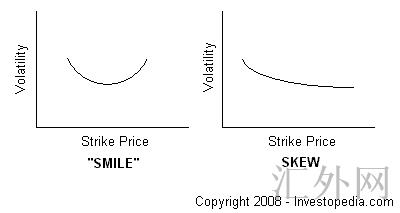

Volatility Skew

外汇网2021-06-19 13:46:44

102

The difference in implied volatility (IV) between out-of-the-money, at-the-money and in-the-money options. Volatility skew, which is affected by sentiment and the supply/demand relationship, provides information on whether fund managers pfer to write calls or puts.Also known as "vertical skew".

标签:

- 上一篇: Listed Option

- 下一篇: Seagull Option

随机快审展示

推荐文章

- 黑马在线:均线实战利器 8764 阅读

- 短线交易技术:外汇短线博弈精讲 4085 阅读

- MACD震荡指标入门与技巧 4220 阅读

- 黄金操盘高手实战交易技巧 4567 阅读

- 做精一张图 3322 阅读

热门文章

- 港币符号与美元符号的区别是什么啊? 25162 阅读

- 我国各大银行汇率为什么不一样啊? 15297 阅读

- 越南盾对人民币怎么算的?越南盾对人民币汇率换算方法是什么 10341 阅读

- 百利好环球欺诈,不给出金,无法联系。 9858 阅读

- 黑马在线:均线实战利器 8764 阅读