Sterling Ratio

外汇网2021-06-19 14:12:18

197

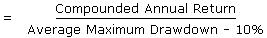

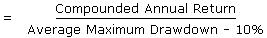

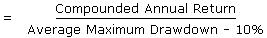

A ratio used mainly in the context of hedge funds. This risk-reward measure determines which hedge funds have the highest returns while enduring the least amount of volatility. The formula is as follows:

标签:

- 上一篇: ISEE Sentiment Indicator

- 下一篇: 12B-1 Fee

随机快审展示

推荐文章

- 黑马在线:均线实战利器 8791 阅读

- 短线交易技术:外汇短线博弈精讲 4106 阅读

- MACD震荡指标入门与技巧 4238 阅读

- 黄金操盘高手实战交易技巧 4590 阅读

- 做精一张图 3336 阅读

热门文章

- 港币符号与美元符号的区别是什么啊? 25290 阅读

- 我国各大银行汇率为什么不一样啊? 15421 阅读

- 越南盾对人民币怎么算的?越南盾对人民币汇率换算方法是什么 10378 阅读

- 百利好环球欺诈,不给出金,无法联系。 9929 阅读

- 黑马在线:均线实战利器 8791 阅读