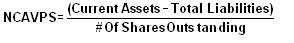

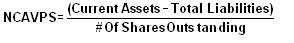

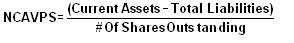

Net Current Asset Value Per Share - NCAVPS

外汇网2021-06-19 13:53:24

88

A value created by professor Benjamin Graham in the mid-twentieth century to determine if a company was trading at a fair market price. NCAVPS is calculated by taking a company's current assets and subtracting the total liabilities, and then piding the result by the total number of shares outstanding.

标签:

- 上一篇: Substandard Health Annuity

- 下一篇: Recharacterization

随机快审展示

推荐文章

- 黑马在线:均线实战利器 8769 阅读

- 短线交易技术:外汇短线博弈精讲 4090 阅读

- MACD震荡指标入门与技巧 4223 阅读

- 黄金操盘高手实战交易技巧 4572 阅读

- 做精一张图 3325 阅读

热门文章

- 港币符号与美元符号的区别是什么啊? 25196 阅读

- 我国各大银行汇率为什么不一样啊? 15326 阅读

- 越南盾对人民币怎么算的?越南盾对人民币汇率换算方法是什么 10347 阅读

- 百利好环球欺诈,不给出金,无法联系。 9867 阅读

- 黑马在线:均线实战利器 8769 阅读