Put-Call Parity

外汇网2021-06-19 13:47:58

88

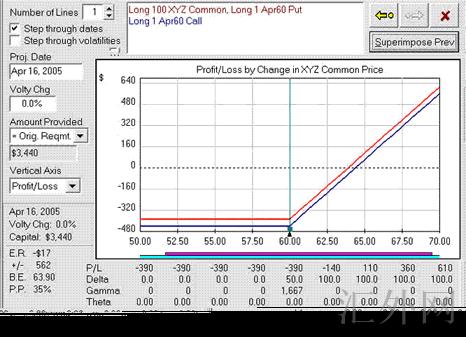

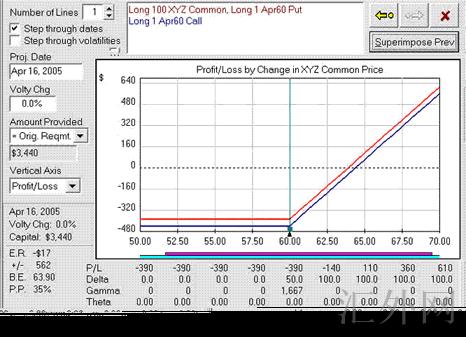

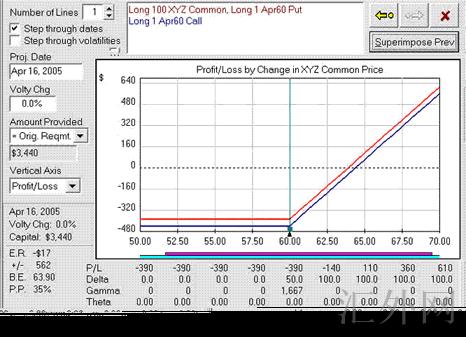

A principle referring to the static price relationship, given a stock's price, between the prices of European put and call options of the same class (i.e. same underlying, strike price and expiration date). This relationship is shown from the fact that combinations of options can create positions that are the same as holding the stock itself. These option and stock positions must all have the same return or an arbitrage opportunity would be available to traders. Any option pricing model that produces put and call prices that don't satisfy put-call parity should be rejected as unsound because arbitrage opportunities exist.

标签:

- 上一篇: Escrow Receipt

- 下一篇: Bermuda Option

随机快审展示

推荐文章

- 黑马在线:均线实战利器 8732 阅读

- 短线交易技术:外汇短线博弈精讲 4068 阅读

- MACD震荡指标入门与技巧 4198 阅读

- 黄金操盘高手实战交易技巧 4545 阅读

- 做精一张图 3301 阅读

热门文章

- 港币符号与美元符号的区别是什么啊? 25020 阅读

- 我国各大银行汇率为什么不一样啊? 15140 阅读

- 越南盾对人民币怎么算的?越南盾对人民币汇率换算方法是什么 10291 阅读

- 百利好环球欺诈,不给出金,无法联系。 9812 阅读

- 黑马在线:均线实战利器 8732 阅读